Did you know #IRS is hiring? Follow @RecruitmentIRS to see what career opportuni…

Did you know #IRS is hiring? Follow @RecruitmentIRS to see what career opportunities await you. https://t.co/CjUF621hrj Source by IRSnews

Ou pa ka kwè gen alèjman fiskal? Ebyen li ka la. Aprann avèk #IRS kòman ou kapab…

Ou pa ka kwè gen alèjman fiskal? Ebyen li ka la. Aprann avèk #IRS kòman ou kapab evite anak yo epi siyale yo sou: https://t.co/nWuR8BeLxP #SiyaleAnakFiskalyo https://t.co/45gBN20ZmI Source by IRSnews

#IRS will offer a free webinar called ‘World of Offer in Compromise.’ Register t…

#IRS will offer a free webinar called ‘World of Offer in Compromise.’ Register to join us on May 26 at 2 p.m. (ET): https://t.co/bAebKK4Tyw https://t.co/6i0Mtdh26m Source by IRSnews

Don’t miss out: If you’re not currently saving for retirement, take a look at th…

Don’t miss out: If you’re not currently saving for retirement, take a look at the #IRS Saver’s Credit today: https://t.co/k9Qa79uyJX https://t.co/cFgj9uUMnW Source by IRSnews

After you file, use the #IRS “Where’s My Refund?” tool to quickly check your ref…

After you file, use the #IRS “Where’s My Refund?” tool to quickly check your refund status. Get started at: https://t.co/PFiedQsvmp https://t.co/e9e5aUOMZ9 Source by IRSnews

The #IRS Small Business and Self-Employed #Tax Center is your one-stop online re…

The #IRS Small Business and Self-Employed #Tax Center is your one-stop online resource for all #SmallBiz and self-employed tax forms and helpful information. Find out more in this #ASL video: https://t.co/ht69Ipizq6 Source by IRSnews

退休金储蓄供款抵免优惠(储户抵免优惠 #IRS …

退休金储蓄供款抵免优惠(储户抵免优惠 https://t.co/z84DuXCoFa #IRS https://t.co/x8Nb20t5hb Source by IRSnews

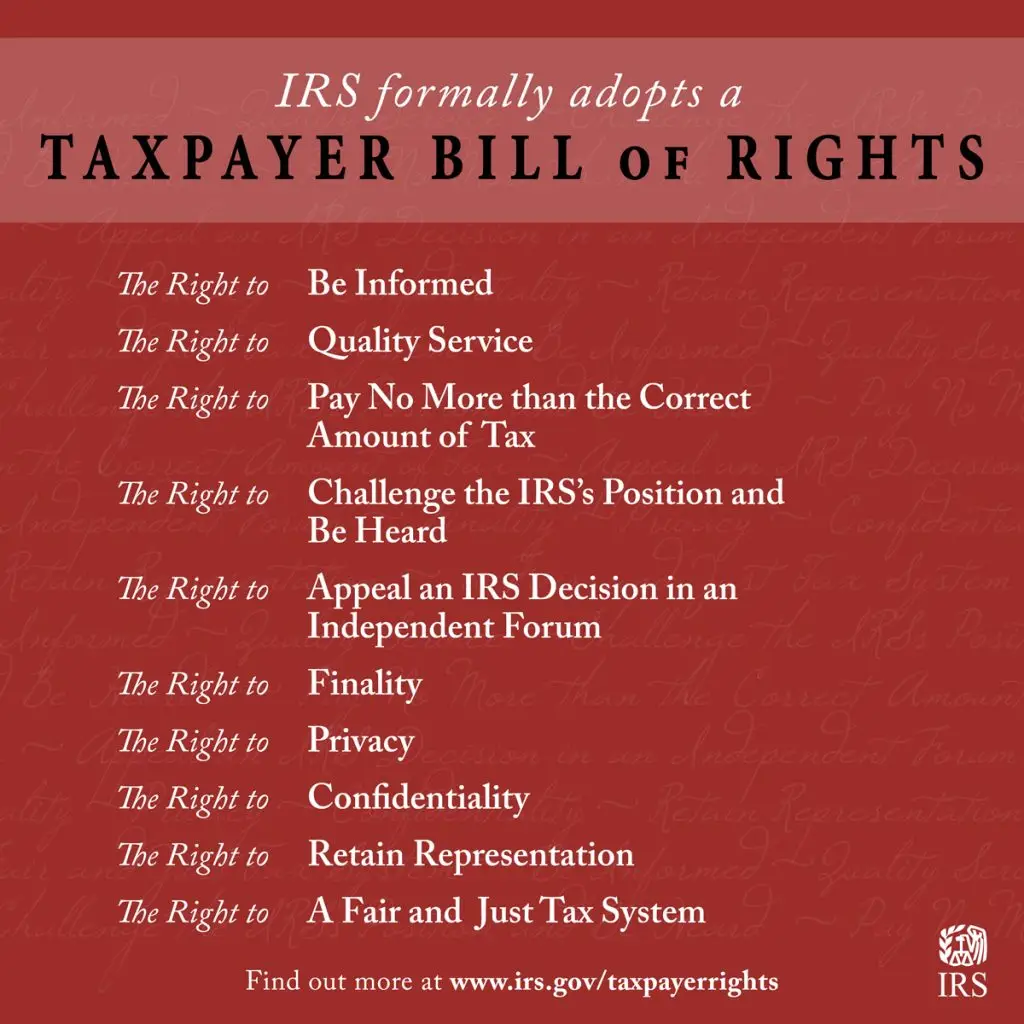

A Taxpayer Bill of Rights is available from #IRS in English, Spanish, Chinese, K…

A Taxpayer Bill of Rights is available from #IRS in English, Spanish, Chinese, Korean, Russian & Vietnamese. https://t.co/5TKblYw6wh #TBOR https://t.co/NP6DrbvcfJ Source by IRSnews

Some ‘ghost’ tax return preparers invent income to qualify their clients for tax…

Some ‘ghost’ tax return preparers invent income to qualify their clients for tax credits. #IRS reminds you that this is a scam that hurts honest people: https://t.co/oT0j4dxbio https://t.co/7JLTvudlWb Source by IRSnews

If tying the knot means you and your spouse now have two incomes, use the #IRS T…

If tying the knot means you and your spouse now have two incomes, use the #IRS Tax Withholding Estimator to calculate the right amount of tax withholding for you this year. For more see this #IRStaxtip for newlyweds: https://t.co/2cUqsg1eob https://t.co/hVxjIfPDNW Source by IRSnews