Aunque no tenga que declarar sus impuestos este año, usted puede ser elegible pa…

Aunque no tenga que declarar sus impuestos este año, usted puede ser elegible para recibir miles de dólares en créditos tributarios estatales y federales. Para más información sobre el #CalEITC y otros créditos visite https://t.co/ccephF0HPz. #EITC #ITIN #DeclareSusImpuestos https://t.co/f4pCJBGUB5 Source by California FTB

¡Si califica para el #CalEITC, presente su declaración de impuestos lo antes pos…

¡Si califica para el #CalEITC, presente su declaración de impuestos lo antes posible! Ya que podría recibir su dinero más rápido. Visite https://t.co/ccephF0HPz para ver si califica. #CalEITC #EITC #ITIN #ValeDelcararSusImpuestos #EssudineroConsígalo https://t.co/NPL8oKAvJ9 Source by California FTB

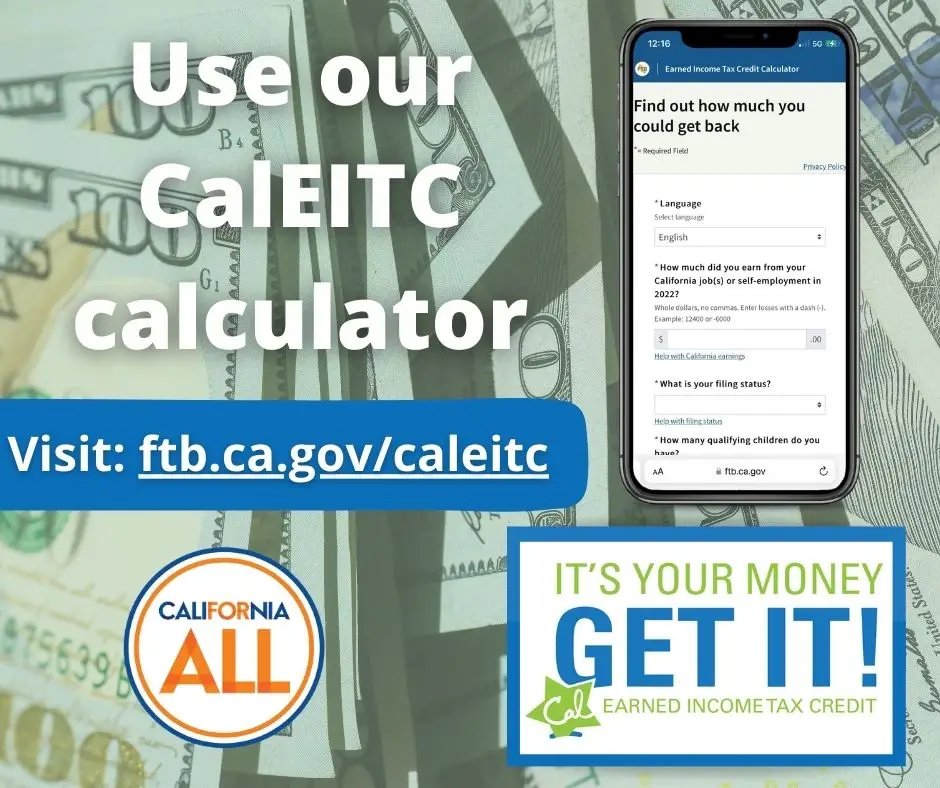

Filing your tax return could be worth hundreds or even thousands of dollars in c…

Filing your tax return could be worth hundreds or even thousands of dollars in cash-back credits if you earn less than $30,000 and have a SSN or an ITIN. Find out more at https://t.co/ccephF0HPz #EITC #ITIN #ItPaysToFile https://t.co/BOCA6Ia7LC Source by California FTB

Declarar sus impuestos podría valer cientos o miles de dólares en créditos tribu…

Declarar sus impuestos podría valer cientos o miles de dólares en créditos tributarios si gana menos de $30 mil y tiene un SSN o un ITIN. Obtenga más información en el https://t.co/ccephF0HPz #CalEITC #EITC #ITIN #ValeDelcararSusImpuestos #EssudineroConsígalo https://t.co/GSn7kVPXLK Source by California FTB

File your return early and qualify for the cash-back California Earned Income Ta…

File your return early and qualify for the cash-back California Earned Income Tax Credit (CalEITC), the state’s Young Child and new Foster Youth tax credits and the federal EITC. Find out more at https://t.co/ccephF0HPz #EITC #IT #ItPaysToFile https://t.co/pOUZVJ9qrF Source by California FTB

The Earned Income Tax Credit or #EITC is a valuable tax credit that can help mil…

The Earned Income Tax Credit or #EITC is a valuable tax credit that can help millions of working people, including foster parents. Get more information from #IRS: https://t.co/AqeTmmH4gx https://t.co/wm37b9m9lc Source by IRSnews

Some Armed Forces personnel and #MilFams may qualify for the #IRS earned income …

Some Armed Forces personnel and #MilFams may qualify for the #IRS earned income tax credit. Do you? https://t.co/AqeTmmH4gx #EITC https://t.co/ggDPHgZa48 Source by IRSnews

#IRS considers members of the military on extended active duty outside the U.S. …

#IRS considers members of the military on extended active duty outside the U.S. as living in the country for #EITC purposes. Learn more: https://t.co/AqeTmmH4gx https://t.co/O6etd2uI71 Source by IRSnews

Help #IRS spread the word this #PrideMonth: Former foster youth & youth experien…

Help #IRS spread the word this #PrideMonth: Former foster youth & youth experiencing homelessness may claim the #EITC on a 2021 tax return, as long as they were at least 18 years old as of 12/31/21 and otherwise qualified for the credit. See: https://t.co/AqeTmmH4gx https://t.co/XtZnw1LlXc Source by IRSnews

Members of the military can include their combat pay as earned income for purpos…

Members of the military can include their combat pay as earned income for purposes of the #EITC, which could increase the #IRS credit. Learn more: https://t.co/AqeTmmH4gx https://t.co/Zwk8ZsBoEz Source by IRSnews